Crypto adoption – how does it matter?

Fear has once again frozen the crypto market in May 2022 when bitcoin’s price plummeted drastically in the fifth major reset to date (read more: “History doesn’t repeat itself…”).

It is nevertheless noteworthy, that during all those crashes the number of addresses on which BTC is stored has continued to grow steadily. This, according to Metcalfe’s law, increases the value of the network itself.

Despite the rampant panic, many industry wizards remain optimistic – arguing that bitcoin as well as the whole industry is right on track. Within only last year, global bitcoin adoption has skyrocketed almost ninefold1.

From trivia to global payment tool

Mass adoption occurs when cryptocurrencies are accepted and approachable to the public on a large scale. It means that people are buying them, treating them as investment goods, and using them in more and more ways in their daily lives. Since 2009, when the Bitcoin software was made available for the first time to the public and mining began, cryptocurrencies have come a winding road.

Nowadays the global crypto population reached almost 300 million and is expected to break one billion by the end of 20222. Many of the biggest and most well-known companies, like Tesla, Microsoft, PayPal, Visa, Mastercard, AXA, Coca-Cola, McDonald’s, and Starbucks accept crypto as payment. Obviously, examples can be easily multiplied.

Going mainstream

Now even countries explore digital assets and blockchain technology as their growth stimulator. When in 2021 El Salvador’s government made bitcoin legal tender, they pushed the first domino to fall in broader global crypto adoption. Then the Central African Republic followed its footsteps, introducing a similar law in May 2022.

This has made an impression on larger countries, and many advocates have emerged to consider the idea of Bitcoin becoming a legal tender. Therefore e.g., Singapore, Brazil, Canada, and Panama are waiting in line to join the crypto club. At the federal level in the U.S., Arizona, Florida, and Texas warmly embraced the cryptocurrency agenda to position themselves as crypto-friendly beachheads. There may be soon even more followers.

What is of the greatest importance in the U.S., the long-awaited bipartisan crypto bill was introduced in June 2022. It aims to provide a comprehensive legal framework to reduce many uncertainties for crypto investors and corporate treasuries. If passed, it would generally regulate cryptocurrency as commodities, rather than securities. This suits much better to decentralized digital assets.

A long way ahead

Although crypto has been a buzzword for many years, much of its popularity growth can be attributed simply to accessibility. While more and more institutions include digital assets in their offer, more investors have them in their portfolios. However, there are still some challenges to address.

The major barrier limiting particularly lower-income individuals to enter the space is the amount of savings and investment capital available. Alongside, financial literacy among potential users is very low. Education in this field is crucial in developing countries, where people have barely any access to tools for money turnover. Even among investors, who are already considering the asset, as many as 42% desire to learn more about bitcoin3.

Let’s be honest, every new technology can be confusing to new users. Furthermore, learning the ins and outs of crypto simply takes time. Additionally, since this space is full of scams and cybercrime, it is easy for the newcomers to get tricked and lose belief in the industry.

The future looks bold

Regardless of the limitations, the market is opening eagerly. 85% percent of US merchants anticipate that digital currency payments will be ubiquitous in their respective industries within five years, while 54% percent of them have invested more than $1 million towards enabling digital currency payments4.

According to ARK Investment’s research, Bitcoin’s market capitalization could scale more than 25-fold in the next decade, with each coin exceeding $1 million in value5. ARK also expects crypto assets and digital wallets to command nearly $50 trillion in equity market capitalization by 2030.

Many other businesses and institutions see long-term adoption of crypto despite – and even because of – the downturn (read more: “When it falls. It grows”). Investing in blockchain technology during “crypto winter” is expected to bring excellent returns in the long term.

Gradually, then suddenly

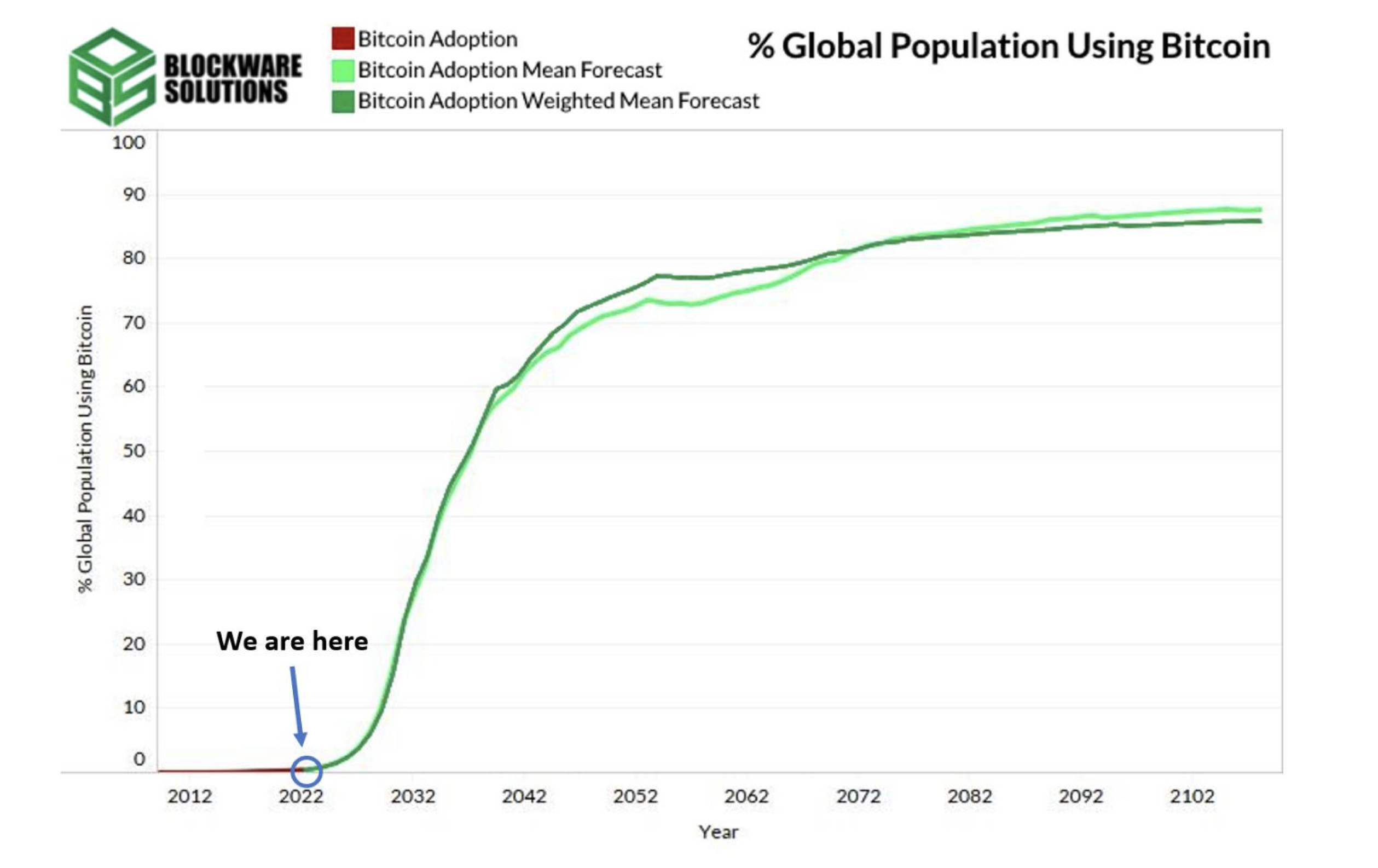

The adoption of cryptocurrency, as does any technological change, often occurs very slowly, until about 8-10%, then explodes upwards. Breakthrough technologies usually follow its adoption curve – an S curve – climbing up through specific segments of their users and constantly overcoming barriers in the way.

Currently, three countries can boast the adoption rate of over 10% (counted as digital currency ownership as a share of population) – Ukraine, Russian Federation and Venezuela6. Analytics forecast that global Bitcoin adoption will reach a critical 10% in the year 20307.

Source: Bitcoin User Adoption, 2022 Blockware Solutions”, https://blockwaresolutions.com/s/Bitcoin-User-Adoption-Report.pdf

Source: Bitcoin User Adoption, 2022 Blockware Solutions”, https://blockwaresolutions.com/s/Bitcoin-User-Adoption-Report.pdf

Accordingly, the whole crypto market is to grow exponentially over the next few years, as global adoption continues to increase. We are pretty sure that the best of crypto is yet to come.

1 „The Global Crypto Adoption Index”, 2021 Chainalysis, https://blog.chainalysis.com/reports/2021-global-crypto-adoption-index/

2 Crypto Market Sizing Report 2021 and 2022 Forecast, Crypto.com, January 2022 https://crypto.com/research/2021-crypto-market-sizing-report-2022-forecast

3 Third Annual Bitcoin Investor Study, Grayscale Research, December 2021, https://grayscale.com/wp-content/uploads/2021/12/Grayscale-2021-Bitcoin-Investor-Study-1.pdf

4 „Merchants getting ready for crypto. Merchant Adoption of Digital Currency Payments Survey”, Deloitte Development LLC 2022. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/technology/us-cons-merchant-getting-ready-for-crypto.pdf

5 „Big Ideas 2022”, ARK Invest, https://ark-invest.com/big-ideas-2022/

6 UNCTAD Policy Brief No. 100, June 202, https://unctad.org/system/files/official-document/presspb2022d8_en.pdf

7 „Bitcoin User Adoption, 2022 Blockware Solutions, https://blockwaresolutions.com/s/Bitcoin-User-Adoption-Report.pdf